Exyn VP Raffi Jabrayan on the role of drones in mining

Raffi Jabrayan, VP, Commercial Sales and Business Development at Exyn Technologies Inc, talks about the growing use of drone technology in mining, and the safety, cost-saving and speed advantages derived from mapping, below and above ground. Drones and their applications are, he believes, in their infancy.

Leading the field with Exyn's drone systems and your new EA6 airframe, what's most exciting to you and your mining customers?

We have a completely autonomous drone package with the mapping payload right on it. Safety is the first and most obvious advantage. Surveyors no longer have to be close to the face, but up to 50 metres behind, under fully supported ground. We're removing the miners from what is historically the most dangerous place - the face of the mine.

The second thing is the speed of operation. We're able to completely map a large area in minutes where traditional surveying methods would take hours. Cutting the amount of time a miner has to spend underground in order to get much better, more accurate data than they used to have is a major way in which we directly benefit the mining industry.

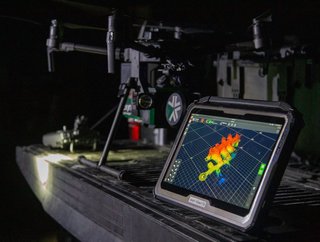

And the drone information comes in real time. Even if network connectivity is lost during the survey the drone will continue its mission uninterrupted, gather all the data and dump it all back onto the tablet once it's all complete and it's back within connectivity.

We've already sent the EA6 out to a number of mines, and we're getting excellent feedback. The flights are very steady indeed. It's performing admirably in the dust, which has historically been quite a headache in mining and aerial platforms.

How has the market for drones developed?

Five years ago just a couple of mines in the world were using drones. Now we've reached the point where if a mine is not using aerial platforms they're getting left behind. I'd say we have the most advanced autonomy in the game. Between ourselves and our competitors, we have covered only 30% to 40% of the market. However, it's a rapidly moving market. Given that we operate underground, many mines are going ever deeper, and many open-pit reserves and resources which are being used up are moving underground, the addressable market is continuously growing for us.

It's been a whirlwind five years. We've been selling into the mining industry for longer than that and the wow factor has not gone away! New customers who are using it now cannot believe the quality of the data that we're able to give them in mere minutes, and the way that they're able to use that data in everyday mining practice.

How are different sectors of the industry applying Exyn technology?

Speaking only about the mining industry, underground mines will use it to map out stopes or larger cavities as well as some larger drifts. Some also use our drones in the mill itself and in processing plants to map out the assets. And again, it doesn't just have to be the drones alone that are used; they can be combined with the handheld data collection that we're able to provide, and then look to do convergence monitoring to see if there's been any movement in where the products have been or where they need to go.

Stockpile monitoring is a big field for us too. Stockpiles and mining go hand in hand, whether it's ore stockpiles or waste or concentrate stockpiles, whether underground or at the surface. Calculations take a tiny fraction of the time that they used to when they had people walking around and manually measuring this material. We've expanded into the construction sector, the automotive sector, and we are also asked to do a lot of work with the government. I think we'll see this LIDAR (light detection and ranging) technology, on board aerial platforms, dominating the market.

How quickly are you finding that your mining customers are engaging in digital transformation?

The mining market was initially slow to get to grips with digital transformation. I feel confident in saying this, given the fact that my background was in mining, I worked for a mining company for almost 10 years, and I actually ran digital innovation for a mining company. But in the last three to four years that has flipped on its head. We see a lot of mining companies doing things that other sectors are following behind on. And this is something that's happening internationally, not just in North America or Europe. Mining has really embraced the way technology can transform their business. One of the great things about our products is that the mine does not need any digital infrastructure to use our digital mapping. They don't need Wi-Fi or tethers or fancy devices. We are able to go into any mine and upload the data to whatever existing platforms they have, within minutes.

From your perspective, what can technology - AI in particular - do for mining and construction?

Well, no discussion is complete until we talk about AI! I think a lot of people might be apprehensive about where AI is headed but it's just how we leverage the technology. We produce a massive amount of valuable data, but that data is only as good as the software that is going to use it. Whether in mining, construction or any other field, it's a matter of leveraging AI to ensure that the data is being used in ways that are targeted to obtain the best outcomes.

Similarly, what about the savings and the quick availability of survey data being achieved?

All of this is quantifiable, right now, to work out your return on investment. ROI is typically three to four months, which is really fast by any standard, given the fact that you are able to do so much in so little time. Whereas in the past it would take say four hours to gather that data, after which you had to take it to the surface and upload it onto the system, you can now do all that in a few minutes, which would save an entire shift. That alone is worth hundreds of thousands of dollars a month. If you're able to see how your blasting is working, and could then adjust that before the next blast, you'd save a lot of money on consumables, time and safety. From a dollars and cents perspective, we know we're making a huge difference to every project our drones are involved with.

So how to leverage the increasing volume of data from the surveys you conduct in various underground environments and reach conclusions of value to global mining business?

We are basically a data-gathering company. The job of analysis is for the software platforms that are capable of crunching our data, to get useful information from it. I think we're just at the beginning of this. Already where traditional surveys may have gathered a couple of thousand points we're gathering a few million within seconds.

Having said that, we've seen different software platforms able to take our data, ingest it, sample it to a more digestible form, and pop it into another end-user software. I think we're just at the very beginning of this. There are a number of companies out there dedicating countless hours and resources to ensuring that companies like us who are putting out these untold amounts of data will be able to store them and present them in a form that all manner of users will be able to leverage.

What further insights would you like to share with our readers?

We are now leading the journey, but I would say that we have a long way to go. To be honest, six years ago I was not really aware of drone technology. But we're beginning to see a generation of young, smart individuals coming out of the colleges who are already growing up with drones. They are familiar not only with drones and their potential but also the different platforms and platform designs and the capabilities of the various sensors that can go on them. ExynAero EA6 is by no means the end product – we are going to see improvements year in and year out for the foreseeable future.

To learn more, visit https://www.exyn.com/.