Top 10 battery raw materials risks

Fastmarkets, the cross-commodity price reporting agency, has announced the launch of its battery raw materials (BRM) risk matrix. The matrix is a graphical representation of the risks arising from the BRM supply chain and has been developed to help planners and decision-makers understand, anticipate and mitigate business planning risks. Battery raw materials are essential to electric vehicles, but they also represent significant risk for the EV market.

10: Geopolitical tensions disrupt production and logistics

Russia’s invasion of Ukraine, which contributed to the London Metal Exchange’s suspension of nickel trading as the three-month price surged by 111% in a day, underscores the extraordinary interdependence of global BRM markets. The threat of geopolitical tensions, plus the concentration of resources, creates an unpredictable and potentially acute risk to a market that is already facing a broad range of persistent geopolitical risks.

09: Inability to clean up supply chains creates reputational risk

The next generation of EV buyers is likely to be more socially and environmentally aware and discerning – and sufficiently active on social media that one credible assertion of greenwashing can impact an automaker’s reputation.

While the electrification of transport reduces emissions from fossil fuels, BRM mining and production raise social responsibility and environmental concerns that can’t be ignored. The lithium market has seen many examples, from Tibet’s concern in 2016 to Chile’s in 2019, and the current stand-off at Thacker Pass in the US. Automakers are vested in cleaning up supply chains; nonetheless, one can imagine that positioning EVs as “clean” or “green” can lead to damaging greenwashing claims.

08: Growth in the use of indexing complicates the path to $100/kWh

Large-scale indexing can drive up the realized cost of materials, batteries, and ultimately the EV itself as more in the supply chain use (elevated) spot prices. When spot prices have risen as sharply as they have, that means higher BRM prices have turned the tide against reaching $100/KWh – creating affordability barriers to mass adoption.

07: Aged price mechanisms hinder investment

Today, a meaningful portion of trade is locked into long-term contracts, temporarily sheltered from price volatility. Although this is helpful to reduce the impact of price increases on players downstream, it has limited the ability to fully realise value upstream and may discourage investments when incentive-level prices are limited. These investments are critical to drive up supply levels to meet expected demand.

06: Insufficient charging infrastructure slows EV adoption

Public charging infrastructure will need to scale up rapidly to serve the growing EV fleet. This requires significant investment in charge point devices, site preparation and installation.

Fastmarkets expects government and commercial entities to accelerate the roll-out of charging infrastructure as EV penetration grows and complementary retail opportunities arise. However, charging deserts can significantly dampen demand; they contribute to range anxiety and discourage adoption outside populous areas.

05: Limited scrap holds back recycling as a supply source

Recycling creates new supply, reduces the carbon intensity of the supply chain, and diversifies away from riskier markets such as the DRC.

The question is not whether recycling will materialize; it is how fast it can scale up. The circular EV economy requires investment, infrastructure, and enough aged EVs and scrap batteries to meet demand.

If the average EV lifespan is 8 to 10 years, battery pack “scrap” may enter the market too slowly. Material shortages can suppress EV growth and give an advantage to those who have better leverage on supply.

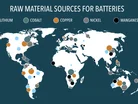

04: Geographic concentrations create supply and logistics risk

Raw materials are geographically concentrated, placing acute pressure in limited areas. This has a significant impact on BRM supply chains. There are continued concerns about artisanal mines in the Democratic Republic of Congo (DRC), the new Chilean constitution, and decisions to stockpile resources in China.

Covid-19 wreaked havoc on supply chains across the globe; its impact on BRM supply was magnified through the lens of geographic concentration. This was felt most in places such as South Africa, where a nationwide lockdown meant delays at borders and bottlenecks at the port of Durban. And Australia, where production was stopped or slowed during periods of strict lockdown.

03: ESG concerns complicate local supply

Local supply is key to meeting surging demand. It can also reduce risk from geopolitical uncertainty and streamline supply chains. But ESG concerns may complicate the rapid build-out of local supply.

The challenge is that local supply is a patchwork of sources that must navigate local laws and regulations and represent new environmental challenges and opposition. Habitat, cultural lands, and water contamination are just some of the ESG considerations complicating current or planned projects.

02: Supply deficits hold back overall EV growth

2021’s manageable shortages will become tomorrow’s acute shortages unless production becomes more efficient and new supply comes online.

Graphite production is expected to increase in China and Mozambique to address the 36% increase in demand in 2022 (from 437,000 to 594,000 tonnes). Production has increased in current lithium mines and new mines are scheduled to start up. Direct lithium extraction (DLE) is expected to drive production gains. Covid-induced staff shortages are abating.

01: Price volatility at elevated levels complicates financial performance

Lithium, cobalt and other BRM prices have surged in the last 12 months as battery makers and automakers have ramped up production and competed for supply. As a result of rising battery raw material prices, one of the world’s most widely produced battery chemistry compositions, NCM 622, is theoretically 150% more expensive than at the start of 2020.

By far the biggest driver of this trend has been lithium chemicals; prices rose by 400% in 2021.