The Battle for Control of Rare Earth Minerals Supply Chain

Nations’ jostling for position in the rare earth minerals market is a never-ending game of chess, and Australia is the latest country to make a telling move.

Australia, in tandem with Western mining allies the US and Canada, is striving to forge a supply chain of rare-earth minerals that is not dependent on the dominant producer China, which supplies around 90% of the world's permanent magnets used in everything from wind turbines to electric vehicles to defence.

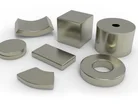

A permanent magnet retains its magnetic properties indefinitely, even upon the removal of an external magnetic field. Neodymium magnets are an example.

This week, a Chinese mining investor failed in a bid to join Australian rare earths mining company Northern Minerals' board, days after Australia's Treasurer ordered the investor's private company to sell some of its shares.

Treasurer Jim Chalmers also ordered several China-linked investors to dispose of Northern Mineral shares, amounting to 10.4% of its issued share capital, on national interest grounds.

Northern Minerals is a producer of heavy rare earths, which are sought after by China.

What are rare earth minerals, and why are they key?

The term ‘rare earth minerals’ refers to a group of 17 metallic elements – including neodymium, scandium and yttrium – that have unique magnetic, luminescent, and electrochemical properties.

This makes them indispensable in the manufacture of powerful permanent magnets used in a wide range of modern technologies, from electric vehicles and wind turbines to consumer electronics and defence systems.

The connection between rare earth minerals and the production of magnets lies in the ability of certain rare earth elements, particularly neodymium, praseodymium, and dysprosium, to create exceptionally strong and lightweight permanent magnets when combined with other metals, such as iron and boron.

China is the dominant producer of rare earth minerals, accounting for a significant portion of the global supply. Other notable producers include the US, Australia, Russia, and India.

China's dominance in the rare earth market has raised concerns among other nations about potential supply disruptions and dependency on a single source.

When it comes to ownership-stakes in companies that produce rare earth minerals, Chinese firms – often state-owned or state-backed – have substantial interests, both domestically and in foreign mining operations.

However, companies from other countries, such as the Australian mining giant Lynas Corporation and the American firm MP Materials, also have significant investments in rare earth production.

The geopolitical landscape surrounding rare earth minerals is marked by increasing competition and concerns over supply chain security.

Countries seek influence on rare earth minerals supply chain

As the demand for these critical resources continues to grow, nations seek to secure stable and diversified sources of supply.

Some countries have implemented policies to support domestic rare earth mining and processing capabilities, while others are exploring alternative technologies or recycling efforts to reduce reliance on imports.

Australia, for example, recently reworked its laws governing foreign investment, in a move aimed at bolstering its role as a global player in the energy transition.

The law changes will increase the domestic processing of critical minerals and rare-earth metals and the production of green technology and energy.

It is hoped the policy, dubbed A Future Made in Australia, will attract private capital through incentives and regulatory changes. But crucially, the country is also looking to remake rules around foreign investment to ensure foreign-backed projects are “in our national interest”, Chalmers said.

Another important strategy in the battle for supply chain clout are bilateral and multilateral trade agreements, as well as diplomatic negotiations.

Environmental concerns, particularly regarding the processing and disposal of rare earth minerals, have also emerged as a significant issue, influencing mining practices and regulatory frameworks.